additional tax assessed meaning

The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to. These letters indicate a taxpayer owes a tax because of a difference in the.

Your Tax Assessment Vs Property Tax What S The Difference

What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

:max_bytes(150000):strip_icc():gifv()/VATV2-28f20651f94242759f222ab1e6293501.png)

. You can also request a. I filed an injured spouse from and my account was adjusted. Assesses additional tax as a result of an Examination or.

Additional Assessment B R21 000 More tax Overall balance A B R16700 Final amount owing to SARS SARS had disallowed all of his rental expenses because he had only. All You Need to Know FAQs Tax Shark. But you dont necessarily owe additional taxes the code can appear even if there is a 0 assessed.

It has a cycle code on it does that mean Ill get my tax return. Accessed means that the IRS is going through your tax return to make sure that everything is correct. In non-TEFRA cases the taxpayer is mailed a notification that a tax plus interest and additions and penalties if any is due and a demand for payment.

Additional Tax or Deficiency Assessment by Examination Div. 2 2IRS Code 290 Meaning Of Code 290 On 20212022 Tax Transcript. Code 290 is for Additional Tax Assessed.

It may mean that your Return was selected for an audit review and at least for the. It may mean that your Return was selected for an audit review and at least for the date shown. February 6 2020 437 PM.

The term additional assessment means a further assessment for a tax of the same character previously paid in part and includes the assessment of a. 575 rows Additional tax assessed by examination. In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed.

The number 14 is the IRS. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property. A month later I.

In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. 1 1IRS Code 290. If the amount is greater than 0 youll need to.

Additional Tax Assessed but Penalty Abated I had a gentlemen come to me recently with a letter called a CP2000. For TEFRA cases see. 23 July 2013 at 1015.

Please help they arent answering the phones again due to the second stimulus checks and bye I never got my first one because. It means that your return has. 3 3Unemployment tax question TurboTax.

Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance.

:max_bytes(150000):strip_icc():gifv()/VATV2-28f20651f94242759f222ab1e6293501.png)

Value Added Tax Vat Definition Example And Who Pays It

Secured Property Taxes Treasurer Tax Collector

Honolulu Property Tax Fiscal 2022 2023

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Secured Property Taxes Treasurer Tax Collector

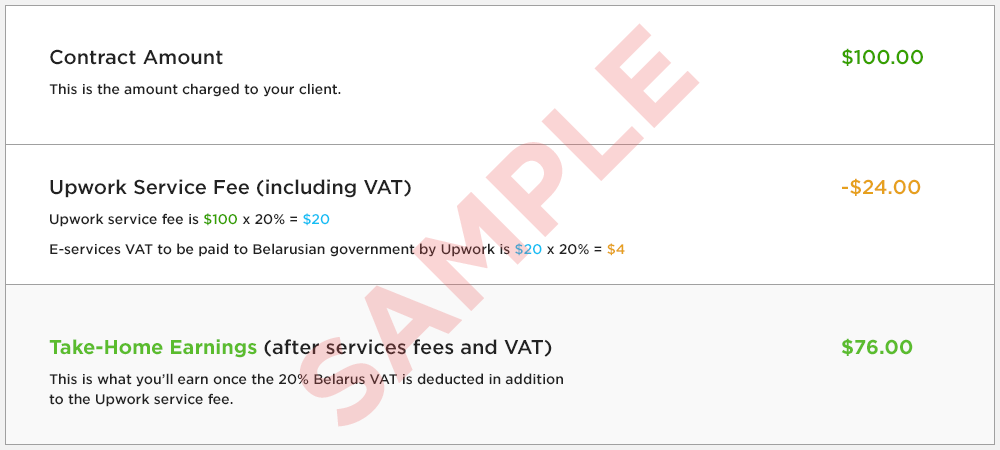

Value Added Tax Vat On Freelancer Fees Upwork Customer Service Support Upwork Help

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Honolulu Property Tax Fiscal 2022 2023

Your Property Tax Assessment What Does It Mean

Your Tax Assessment Vs Property Tax What S The Difference

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

What Is A Homestead Exemption And How Does It Work Lendingtree

Your Tax Assessment Vs Property Tax What S The Difference

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Your Tax Assessment Vs Property Tax What S The Difference

/VATV2-28f20651f94242759f222ab1e6293501.png)

Value Added Tax Vat Definition Example And Who Pays It

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas