north dakota sales tax registration

The Secretary of States web site provides a. Thank you for selecting the State of North Dakota as the home for your new business.

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

North Dakota Licenses and Permits.

. North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

If you only need to file a North Dakota sales tax return. Ad Fill out one form choose your states let Avalara take care of sales tax registration. Or file by mail using the North Dakota Application.

Sell Flow Line Equipment Minot ND 58701. Registering Your Business Name. North Dakota Sales-Tax-Registration File for North Dakota Business Licenses and North Dakota Permits at an affordable price.

Dont waste your time run. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. Simplify the sales tax registration process with help from Avalara.

Sales Tax Nd information registration support. Taxable sales include all taxable sales of products or services through the marketplace on behalf of all sellers. If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline.

North Dakota Sales Tax Application Registration. In order to have a North Dakota resale certificate you must first apply for a North Dakota sales and use tax registration. This permit will furnish your business with a unique sales tax number.

Apply online at the North Dakota Taxpayer Access Point TAP. Registration period is from January 1 2020 through December 31 2022. January March Q1 April 30.

This permit will provide you with a North Dakota Tax ID number sales. We recommend submitting the application via the. The information on this site is general information and.

Business structures range from informal sole proprietorships to complex corporations with publicly traded stock. Ad New State Sales Tax Registration. For vehicles that are being rented or leased see see taxation of leases and rentals.

Registered users will be able to file and. Sales Tax Nd information registration support. Simplify the sales tax registration process with help from Avalara.

800 524-1620 North Dakota State Sales Tax Online. Welcome To The New Business Registration Web Site. Ad New State Sales Tax Registration.

The state of North Dakota became a full member of Streamlined Sales Tax on October 1 2005. How to register for a sales tax permit in North Dakota. The New Business Registration site assists businesses starting or relocating to North Dakota with planning financing registration and licensing issues.

New Business Registration North. Form 306 - Income Tax Withholding Return. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

Marketplace facilitators required to register and collect sales and use taxes in. How do you register for a sales tax permit in North Dakota. After reading the guidelines complete the.

There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online website. Motorboats under 16 feet in length and all canoes regardless of length powered by a. Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of. October December Q4 January 31. Ad Fill out one form choose your states let Avalara take care of sales tax registration.

DeRobert xyz Starting my own Mchenry County North Dakota Tax Sales Registration. A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by. The topics addressed within this site will assist you.

July September Q3 October 31. North Dakota Tax Sales Registration 58701. Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to.

April June Q2 July 31. In addition to taxes car. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

Printable North Dakota Sales Tax Exemption Certificates

North Dakota Sales Tax Refund For Canadian Residents Fill Online Printable Fillable Blank Pdffiller

![]()

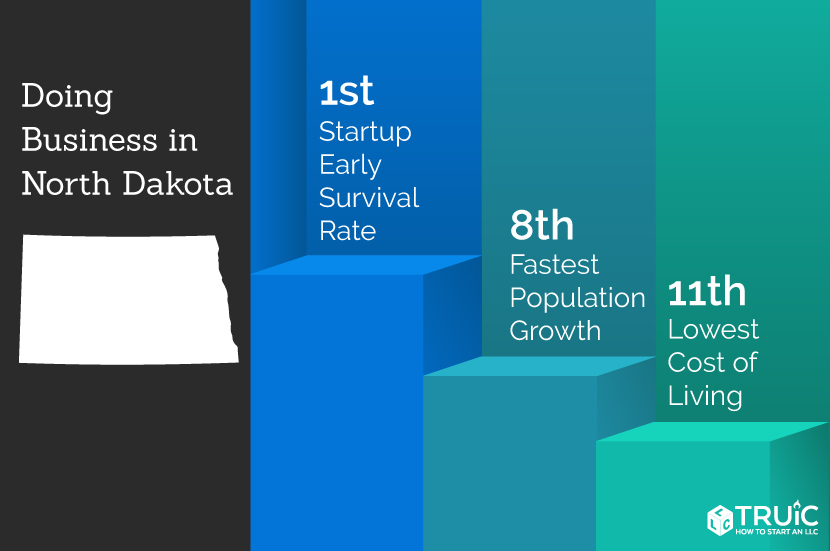

North Dakota Llc How To Start An Llc In Nd Truic

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Instructions On Obtaining A Resale Certificate Sales Tax License

How To Register For A Sales Tax Permit Taxjar

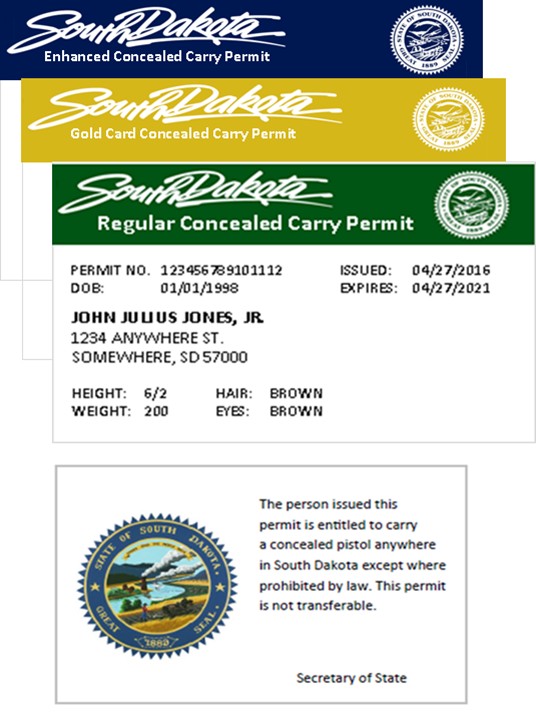

Concealed Pistol Permits South Dakota Secretary Of State

How To Register For A Sales Tax Permit In North Dakota Taxjar

How To Start A Business In North Dakota A How To Start An Llc Small Business Guide

About The North Dakota Office Of State Tax Commissioner

How To Register For A Sales Tax Permit In North Dakota Taxjar

South Dakota Unemployment Benefits Eligibility Claims